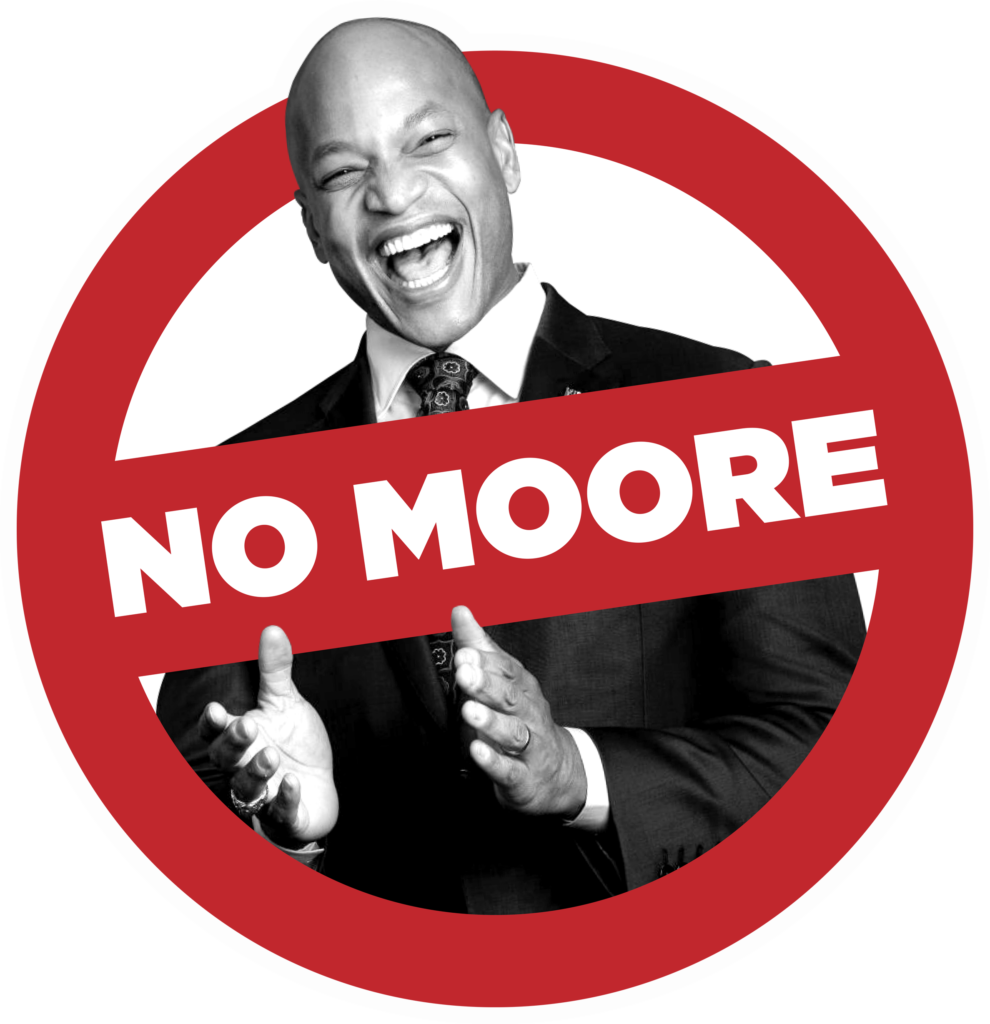

NO MOORE RECKLESS SPENDING | NO MOORE TAX HIKES

DONATE TODAY TO STOP THE RECKLESS SPENDINING AND ENDLESS TAX AND FEE HIKES!

THE LARGEST TAX AND FEE HIKE

IN STATE HISTORY

Governor Wes Moore inherited a record $5.5 billion surplus — the largest in state history and in just two years TORCHED IT with his tax-and-spend cronies in the Maryland legislature. Facing a budget deficit from reckless spending, they just rammed through THE LARGEST TAX AND FEE HIKE IN STATE HISTORY. Since then, the Moore Administration is gaslighting Marylanders while families and small businesses pay the price. We’re here to expose the truth, hold them accountable, and make sure no one forgets who broke Maryland’s budget.

CONSECUTIVE TAX AND FEE HIKES TO DATE

43

GovernorMartin O'Malley

338+

GovernorWes Moore